December is the month that many companies hold annual employee performance reviews.

Built into these reviews is an employee expectation that a positive performance review will result in some sort of pay increase or raise. Often, owners have a set amount of money which they have discretion to allocate based on the performance review.

If you search Google for “annual performance review and raise” you’ll notice that the top 9 results all focus on helping employees ask for a raise. Only one article talks about how performance reviews and raises shouldn’t be linked.

Clearly, raises and performance reviews are linked in the mind of most employees.

Employees feel if they get a good performance review (do a good job), a raise is soon to follow.

However, employee performance is often not linked to company results which sends the wrong message – the individual can still win (get a raise) even when the rest of the team loses (the company is not successful). It would be like one member of a football team celebrating because their individual performance was solid while the score shows a loss.

To change this mindset, it’s critical to link an employee’s performance to the financial goals of the company. If you don’t you could have the following problems:

(1) An upset employee who is expecting their hard work to result in a raise and is frustrated when this doesn’t happen

(2) Poor company results due to poor alignment of an employee’s day to day with what drives company results

(3) A, “as long as I win, who cares if the team loses” attitude

So how do you change this? How how do you link and employees bonus to company results?

Establish A Budget And Determine The Company’s Financial Goals

Probably the most important component of linking an employee bonus to company results is predicting what the company’s financial goals should be and what “winning” looks like.

You do this by creating a budget.

I’ve written a couple of posts on creating a budget for your business which you can read here and here. Budgeting is about learning and making your business as predictable as possible. Budgeting is also a tool you use to drive results.

Once you’ve created the budget, you can determine the break even for the company and project how much profit is available for a bonus pool.

Set A Profit & Cash Threshold For Employee Bonus Payouts

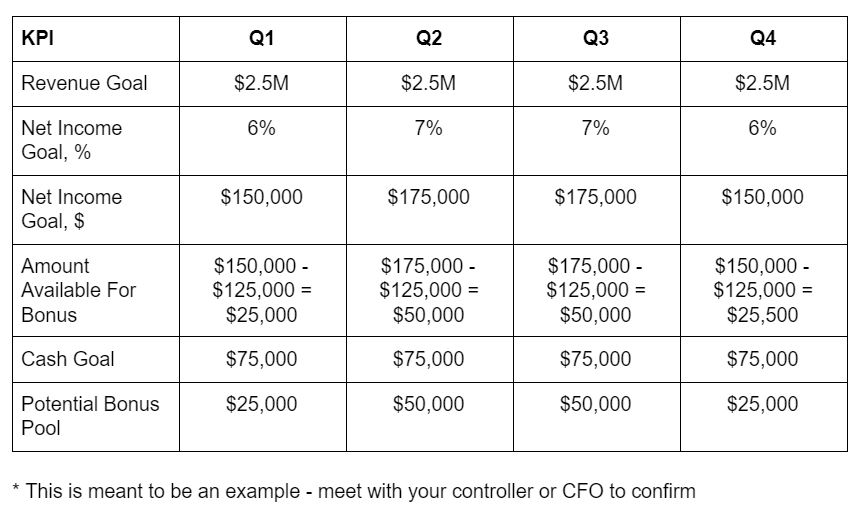

Plans like the Scanlon Plan and the Great Game of Business suggest setting a threshold of at least 5% net income and then allocating a percentage of whatever exceeds the 5 % to a bonus pool.

For example, say you have a $10M company which generates a 10% net income or $1.0M.

$500K would cover the 5% threshold and remaining 5% would be available for the bonus pool (of course you can go as high or as low as you’d like).

You could plan to offer 25% of the $500K or $125K to the bonus pool.

The $125K bonus pool would then be allocated to employees at each manager’s discretion and based on specific performance criteria.

If you have 40 employees and spread the bonus evenly, that is a max opportunity of $3125 per employee (you could create different levels, managers receiving more etc…).

You could then break this out over Q1 – Q4 – see below:

If the company does not generate at least 5% in net income, no bonuses would be paid out. This where you eliminate the “as long as I win, who cares if the team loses” attitude. This process also tunes everyone in to what “winning” looks like for the company and can begin to help them make decisions which impact profitability.

I would suggest that you have a cash threshold as well. A company may be profitable, but there is not enough cash due to Capex or even AR which is behind. All this could be planned in advance.

Break These Goals Down Into Quarterly Goals

It’s important to break the financial goals down into quarterly goals to sufficiently motivate the employees. It also allows for certain seasonality.

Make Sure Each Employee Understands The Company Goals (And How The Company Wins)

This is where employee education comes into play.

You need to educate every employee on how a business makes money, how to read a P&L, how profit is calculated, what is Gross Margin and what is overhead or OpEx. This is a process.

Employees may think that because the business generated $2.5M in revenue in one quarter, that it MADE $2.5M. Crazy I know, but an educated employee is an extremely valuable resource, so teach them. Your employees are the closest to the action and if they know they have a stake in the game, they will become really engaged – really quickly.

Hold a quarterly meeting where you show them the plan and explain to them how they can impact the results. Teach them how the business wins (to make a profit and generate cash).

Once you do, employee will begin thinking about how to reduce your OpEX. They will begin protecting cash by asking questions lke, “so we really need that CAPEX?”

Some owners don’t believe sharing all this information with their employees helps (and could even hurt). I encourage you to read The Great Game of Business for a real world example of a company that went through this process and flourished.

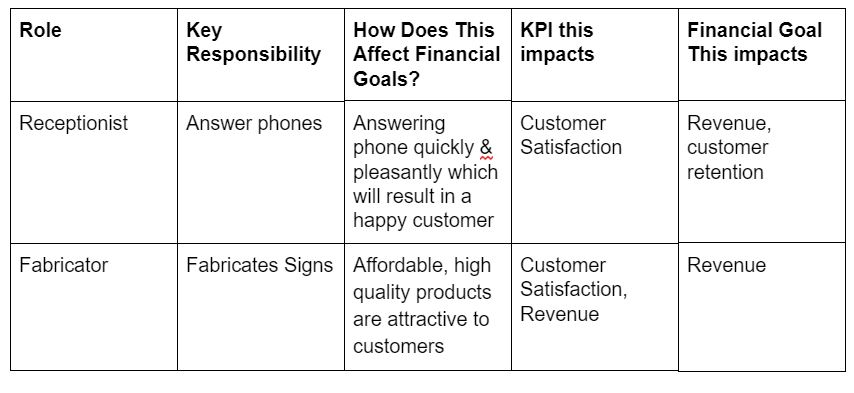

Link Each Employee’s Day To Day To The Company’s Financial Goals

How does the person who answers the phone contribute to the company’s financial goals? You need to think through each role and make the connection for each employee. This can take time, but is well worth the effort.

I like to use a simple strategy map for this. Here’s a couple examples.

It may not be immediately apparent, but some thinking on the matter can reveal how each role adds value to the customer. If you don’t understand how each role adds value, I might suggest that you don’t need that role or need to dig a bit deeper.

Learn And Iterate

The fact is, when you first roll out a plan like this, there will be flaws.

Some may feel it’s unfair, other’s may not care, but stick with it. I encourage you to gather the critical feedback and continue to update the plan.

What If The Company Doesn’t Reach It’s Goals, Doesn’t That Demotivate Employees?

Yes, but I think that is a good thing. Let me explain.

Clearly linking employee performance to company financial performance does the following.

When the company misses its targets, the entire company misses its targets. Everyone misses the targets. Everyone feels the pain of loss. It’s not just, “sales couldn’t bring in the number for the month”.

Every employee becomes tuned into the problem. Now you have a group of people who shouldn’t want that to happen again. The team lost, how can we win as a team?

By the way, you will also clearly see who your team players are and who are just in it for themselves. You will see those individuals that truly believe in the vision of the company and those that do not. Those that are there just for a paycheck.

Gather your team together and form a group to solve the problem. Engage your people. Ask them to help solve the problem.

I’ve seen way too many business owners bear the weight of all this by themselves. It shouldn’t be that way.

I hope this has opened your eyes to the possibility of truly linking an employee’s raise or bonus to company results.

Here are a couple resources that can help you move in that direction:

Download our our company goal setting guide – you’ll need this to make sure your company goals are clear

Accountability chart – you’ll need this to clarify each employee’s goals and key responsibilities.

Demo of Envisionable – if you’d like a tool that tracks your KPIs and goals in one system, we’d love to give you a demo.