In my recent blog post, “Seven Signs You Need A Business Operating System”, I called out the seven common problems that small businesses face and how those problems can be solved using a business operating system.

We’ve defined a “business operating system” as a set of structured activities help drive following critical elements in your small business:

- Clarity

- Alignment

- Execution

What do I mean by clarity, alignment and execution?

Clarity – This is clarity regarding the future. It’s clarity about where you are leading the business in the next 5 years. It’s clarity about how you expect employees to behave (your core values) and clarity about why you do what you do (your mission, “why” or core purpose).

Once you have clarity around these things, you can begin defining a set of goals. These goals create clarity about your strategy or HOW you are going to make your future vision a reality.

Once clarity is attained, alignment comes next.

The process of clarifying where you are leading the business drives alignment by attracting those who believe in the vision you articulate and naturally repel those who don’t. The clearer you are the more your team can react to that vision.

Once you have clarity and alignment around your clear future picture, execution becomes much easier.

Execution is hard, but being clear and in alignment around WHAT needs to be executed is a game changer. What you focus on naturally gets better.

So back to the original point about the problems a typically small business faces. See if any of these resonate with you:

- The business feels chaotic and out of control.

- Increased sales is not resulting in increased profit.

- There is a high rate of employee churn. As soon as you hire someone, another person leaves. Employee retention and hiring is a problem.

- There is poor accountability. Employees are not 100% clear on their key responsibilities. This results in dropped balls, frustrated customers and stressed out employees.

- Meetings feel like a waste of time and ineffective or seen as complaint sessions where nothing ever really gets accomplished or solved

- The business is in constant fire-fighting mode, moving from one fire to the next.

- There is no budget which is used to plan spending. You do not have the information to make decisions. Cash flow is a problem.

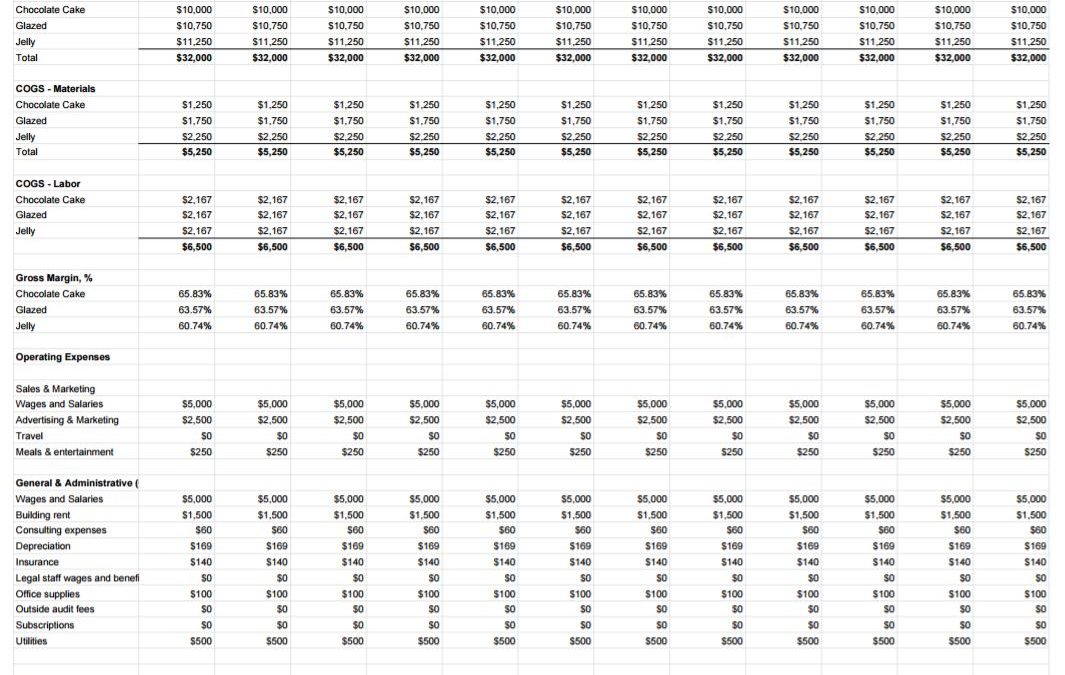

In this blog post, our focus on the final problem in the list- “There is no budget which is used to plan spending. You do not have the information to make decisions. Cash flow is a problem”

There is a lot that can be said about this, so let’s get started.

Why A Budget?

Do you have a budget for your small business?

In my experience, if you don’t have a budget, don’t feel bad, you are in the majority. However, a budget is a critical tool to drive clarity, alignment and finally execution.

A Budget Drives Clarity

A budget, is a clarity creation tool.

A budget forces you be very clear on a number of things. You need to literally pick a number.

- How much you plan to do in revenue – pick a number?

- How much will it cost you to deliver the product or service you sold? – pick a number

- How much will you spend to market your business? – pick a number

- How much will you pay employees to service / sell? – pick a number

- How much will you pay yourself? – pick a number

- How much will you invest in a new product or service? – pick a number

….and you get the picture. Talk about 100% clarity.

Now, you may not know what the number is, but a budget forces you to pick a number and this process alone drives clarity.

Once you pick a number, you can then put the actual number in that slot. You can begin measuring that number.

For example, you picked a number for revenue in June of $100K. The actually number was $50K! What happened? Why was it much lower? Did we have the wrong assumptions? Did we lose a customer?

You can see how this simple exercise drives a ton of clarity about the reality of your situation which is the first step in solving a problem.

A Budget Drives Alignment

A budget also drives alignment. A budget encapsulates your business priorities in black and white. Creating a budget with your team is a great way to test the assumptions you are making.

Remember our sales goal of $100K for June? How is that goal going to be attained? Who is going to generate those sales? From what customers?

Having these discussions using real world numbers which are validated by your team naturally drives alignment and highlights areas of misalignment. More alignment equals better execution and results.

A Budget Drives Execution

A business is not all about revenue or profit, but in order to stay viable, your business must execute and hit certain revenue, profit and cash flow targets. When these targets are missed the health of the business is in danger. Miss these targets long enough and you are out of business.

A budget acts as an early warning sign to a business that is in danger.

Using our example from earlier, if you’ve budgeted to do $100K in sales in June, but did only $50K, you have an early warning sign.

What caused the team not to execute? How will you make up the $50K that you are now short? Was there a lack of execution which caused the team to miss the target? What specifically does the team need to do to ensure the target is hit? These are all execution questions.

When the sales target is missed, the rest of the team needs to adjust to hit their targets.

Again, budgets forces a conversation around what was expected to be executed. That conversation can be used to improve execution going forward.

Clarity, Alignment and Superior Execution Is A Cycle

I’m sure you can see how having a budget can drive real results in your business.

Not generating superior results in your business? You need a business operating system.

Need help, contact us for a FREE 15 minute strategy call to see if we’re a good fit.